Public practice is governed by the Accountants Act 1967, Membership and Council Rules 2001 and MIA By-Laws (On Professional Ethics, Conduct and Practice).

Under the Act, the person must be a member of the Institute, and is prohibited from public practice through a body corporate except where it is allowed by other statutes for limited areas of public practice, such as provision of tax services, corporate secretarial services and even as investment advisors.

A member, in most instances, is allowed to be engaged in public practice as a sole practitioner or in partnership only with another member(s) as the Act and By-Laws prohibits the sharing of profits with non-members. All firms in public practice are described as firms of chartered accountants.

Only members registered as chartered accountants with valid practising certificate can describe and hold themselves out as chartered accountants in public practice and are able to set up firms providing public practice services.

Public Practice services includes:

- auditing including internal auditing;

- accounting and all forms of accounting related consultancy;

- accounting related investigations or due diligence;

- forensic accounting;

- taxation, tax advice and consultancy;

- bookkeeping;

- costing and management accounting;

- insolvency, liquidation and receiverships;

- provision of management information systems and internal controls;

- provision of secretarial services under the Companies Act 2016]; or

- such other services as the Council may from time to time prescribe.

Members also must have their principal or only place of residence in Malaysia to be in public practice in Malaysia.

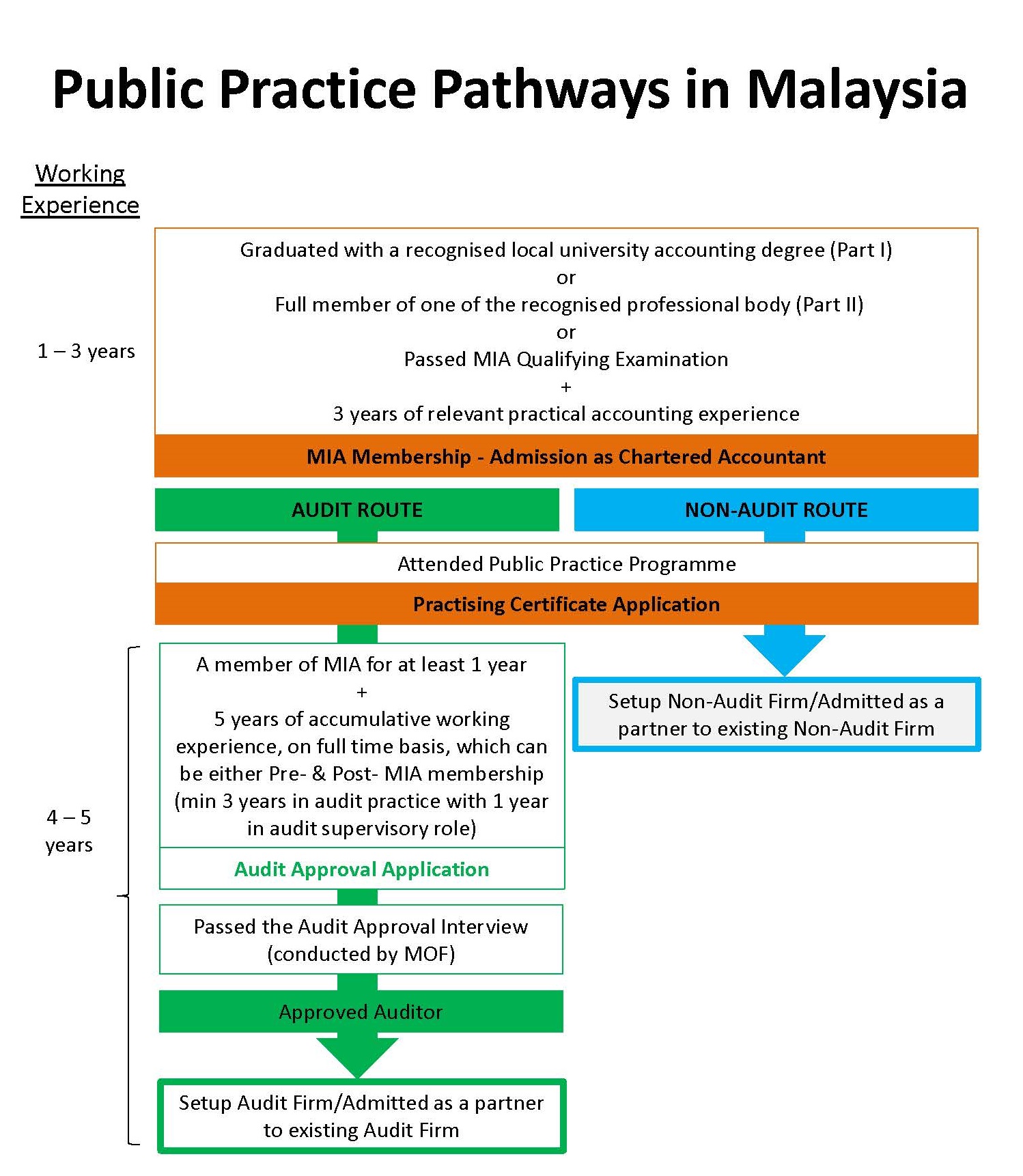

Members who wish to set up a practice must first obtain the approval of the MIA on the use of the firm’s name. There are 2 types of firms which are audit and non-audit.

Professionals governed under their respective acts are exempted from premise licensing under Section 102 (s) of Local Government Act and Licensing of Trades, Businesses and Industries (Federal Territory of Kuala Lumpur) By-Laws 2016. Hence, audit and non-audit firms of Chartered Accountants under the Accountants Act, 1967 are exempted from premise licence requirements by the local Council. However, the signboard licence is still applicable.

No additional licensing requirements are needed and member can register a non-audit firms.

To be an auditor a member must be in possession of an audit licence granted by the Accountant General’s Office pursuant to the Companies Act 2016.

- The requirements for applying for an audit licence are as follows:-

- Is a member of the Malaysian Institute of Accountants (MIA) under the Chartered Accountant category. In addition, the applicant has to be a member of the MIA for at least one (1) year.

- Possess a valid Practising Certificate issued by the MIA.

Possess sufficient working experience in audit practice in a public accounting firm:

- The candidate must have at least 5 years of working experience prior to application. The 5 years accumulative working experience can be obtained prior to and/or after becoming a Chartered Accountant of the MIA.

- At least 3 years must be in audit work.

- At least 1 year out of the above 3 years shall be in an audit supervisory role. The audit supervisory role is defined as being responsible for audit management including consultation with audit partners and has experience in giving opinions for financial statements and be directly involved in audit planning.

- Candidates who have left audit practice, but still within a 3 year period prior to the application to be approved company auditors, are still eligible to apply.

- For candidates who have left audit practice for more than 3 years, they must work for at least 1 year in audit in the Malaysian environment.

- Experience in other countries can also be considered however, they must work for at least 1 year in audit in the Malaysian environment.

- Candidates are required to attend the “Public Practice Programme” organised by the MIA.

To be a liquidator, a member must be in possession of a liquidator licence granted by the Accountant General’s Office pursuant to the Companies Act 2016.

The requirements for applying for a liquidator licence are as follows:-

- Must be a Malaysian citizen or permanent resident;

- A member of recognised professional body under Section 433(5) on the Companies Act 2016 and hold a valid Practising Certificate;

- Not a bankrupt, not been convicted in the immediate past 5 years whether within or outside Malaysia of any offence involving fraud or dishonesty relating to the promotion, formation or management of any body which punishable on conviction with imprisonment for three months or more;

- Possess sufficient working experience in liquidation practice as follows:

- 5 years of full-time working experience in the field of liquidation;

- Candidates who have left liquidation practice, but still within a 3 years period prior to the application to be approved company liquidators, are still eligible to apply.

- For candidates who have left liquidation practice for more than 3 years, they must work for at least 1 year in insolvency in the Malaysian environment.

- Experience in other countries can also be considered however, candidate must work for at least 1 year in liquidation in the Malaysian environment.

- A sponsor letter from an approved liquidator who has supervised the candidate;

- Must have the capacity in carrying out the duties as a liquidator.

The issuance of a licence to be a tax agent is governed by the Income Tax Act 1967.A licence is only granted after the applicant has passed an interview conducted by the Inland Revenue Board.The practice of taxation may be carried out under a body corporate. However, it has to be established as a separate entity from that of a public practice and may not be referred to as a tax consultant or tax adviser. Only members who hold themselves out as chartered accountants with valid practising certificates may use these descriptions under a sole proprietorship or a partnership. A body corporate cannot be described as chartered accountants and it cannot be registered as a member firm of the Institute.

MIA is one of the recognised bodies under Fourth Schedule of the Companies Act 2016, which qualify its member to become a company secretary. Section 241 of the Companies Act 2016 requires any person who is qualified to act as a secretary and who desires to act as a secretary to register with Suruhanjaya Syarikat Malaysia (SSM) before he can act as a secretary. SSM will issue a practising certificate for company secretary upon satisfaction on the qualification and requirements specified under the Companies Act 2016, regulation and guideline.Requirements to act as company secretary for MIA members:

- a natural person;

- eighteen years of age and above;

- a citizen or permanent resident of Malaysia;

- not disqualified under section 238 of the Companies Act 2016; and

- not have any pending legal action under any provision of the laws specified in the First Schedule of the Companies Commission of Malaysia Act 2001